Table of Contents

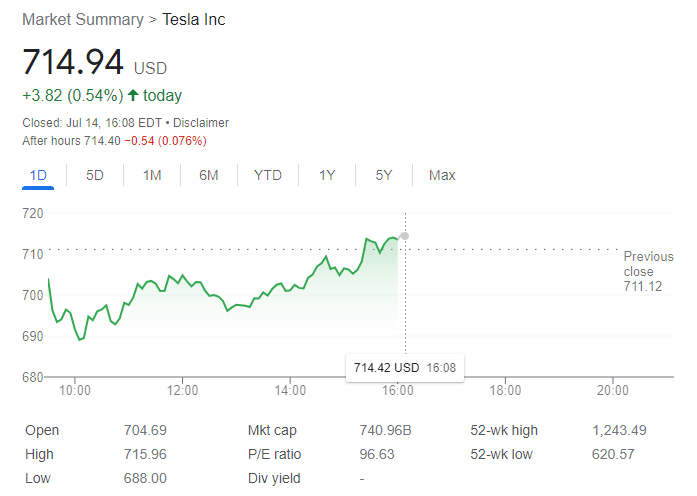

- Tesla stock extends gains on Thursday and settles at $714.94.

- TSLA stuck in a wide band of $620 to $760.

- Twitter files go well with towards Tesla CEO Elon Musk.

Update: Tesla (TSLA) shares have been up .54% on Thursday and shut at $714.94. Wall Avenue began the working day dip in the red as fears of a recession undermined desire for high-yielding belongings. Having said that, US indexes managed to bounce again after Federal Reserve Governor Christopher Waller noted that marketplaces may have gotten ahead of by themselves by pricing a 100 foundation details amount hike in July, introducing that a 75 bps hike will deliver them to neutral. The Dow Jones Industrial Normal completed the working day down 142 factors, even though the S&P 500 dropped .30%. The Nasdaq Composite managed to insert 3 details or .03%.

Tesla (TSLA) remains unstable and directionless, both of those in phrases of inventory overall performance and its autonomous driving device. The inventory has been below strain for most of 2022 but so significantly has held the essential $620 help. Tesla has been caught in the downdraft from Elon Musk’s try to invest in Twitter (TWTR). As issues transform unappealing in that sphere, traders are making an attempt to ascertain how that impacts Tesla. It could be witnessed as a optimistic with Elon Musk now fewer stretched on the acquisition and free to target extra electricity on Tesla. A different favourable can be taken from the absence of any need to have to pledge Tesla stock as collateral for the Twitter deal, but the information on Tuesday that Twitter experienced filed suit despatched Twitter shares greater in hopes of likely pushing the offer by means of. This, in our perspective, is remarkably unlikely.

Tesla Stock News: Is Tesla now driverless?

As properly to the fury surrounding the Twitter lawsuit, it also came to mild on Wednesday that Tesla’s Head of AI has now formally left the organization soon after a four-thirty day period crack.

It’s been a terrific pleasure to support Tesla to its targets more than the past 5 decades and a tricky final decision to part techniques. In that time, Autopilot graduated from lane maintaining to metropolis streets and I glance ahead to viewing the extremely powerful Autopilot crew proceed that momentum.

— Andrej Karpathy (@karpathy) July 13, 2022

I have no concrete plans for what’s next but glimpse to invest far more time revisiting my extended-phrase passions all-around technical function in AI, open resource and education.

— Andrej Karpathy (@karpathy) July 13, 2022

Thanks for all the things you have completed for Tesla! It has been an honor operating with you.

— Elon Musk (@elonmusk) July 13, 2022

Tesla has not too long ago declared a hold off to its AI day right up until September 30, so probably this is to announce some development or substitute? Possibly way, it results in additional uncertainty for the inventory.

Tesla Inventory Forecast

My quick situation in Tesla is a lot more of a macro look at somewhat than a damaging acquire on Tesla by itself. Tesla is 1 of the greatest shares out there in terms of P/E and other multiples. In a combined monetary and fiscal tightening circumstance, stocks this sort of as this are inclined to rerate rather sharply. I do sense Tesla has some difficulties forward, but these are not unique to Tesla. The automaker will most likely navigate them far better than legacy automakers who are notoriously awful at navigating recessions.

Tesla has experienced a no cost run at the EV sector just as Netflix experienced a absolutely free operate at the streaming sector, and search what happened future when the legacy providers entered. Most Wall Street analysts forecast Tesla to have a sector share of 15% of the EV or auto market. This is way much too significant in my opinion. No automaker has ever managed to have these types of marketplace share to my understanding. Toyota is currently the world’s variety 1 with a 10% current market share.

Technically, $620 stays the important degree. A split there must direct to a move to $540, but there is a volume hole until $430 and things could get actually ugly if $620 breaks. This current phase seems to be like a consolidation phase immediately after the transfer lessen. Consolidation phases commonly consequence in a breakout in the direction of the preceding development, i.e. bearish. Breaking $760 finishes this and probable finishes my brief!

Tesla chart, weekly

The writer is limited Tesla and Twitter.

More Stories

Mercedes To Gradually Eliminate Manual Gearbox From 2023

Tesla Stock Vs. BYD Stock: Tesla Rebounds As China EV Rival Flashes Buy Signal

2022 Kia EV6 Review: One of the best EVs yet