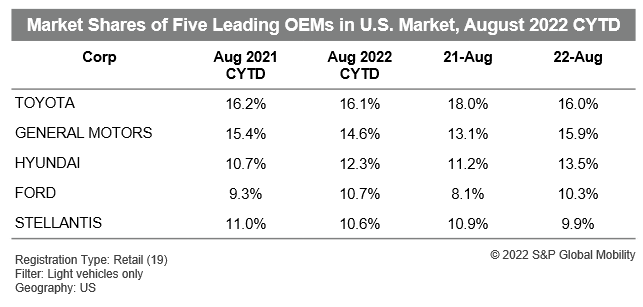

Hyundai Motor Team not too long ago has emerged as a single of the

leading-doing new motor vehicle brands in the US. New-car or truck

registration information from S&P Worldwide Mobility through the 1st

8 months of this 12 months (see desk beneath) reveal Hyundai Motor

now ranks as the No. 3 OEM in the US, primarily based on retail corporate

industry share. The mixed Hyundai, Kia, and Genesis manufacturers now

surpass perennial powerhouses Ford Motor Firm, Stellantis Corp.,

and American Honda Motor Co., Inc.

Hyundai Motor’s overall performance has been pushed by (at least) three

strengths, which includes the freshness and timeliness of its a few U.S.

product or service portfolios, the robust brand name loyalties of Kia and Hyundai

house owners, and substantial producer loyalty throughout all a few brands.

Product or service Portfolios

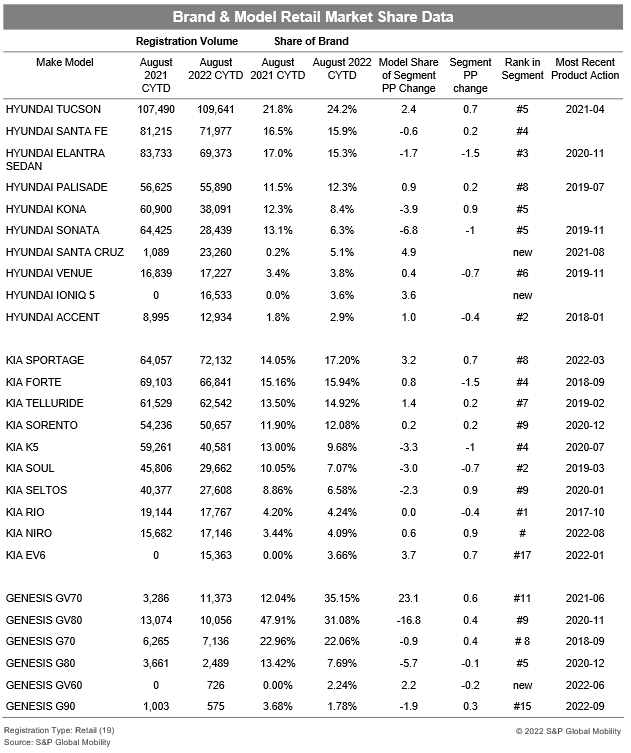

As illustrated in the desk below, each Hyundai-branded

in-industry model other than the discontinued Accent has been possibly

introduced or re-built given that mid-2019. Similarly, each individual Kia product

other than Rio and Forte has been introduced or re-created considering the fact that early

2019. Genesis’s portfolio is similarly clean, with just the G70

languishing in its existing type considering the fact that the finish of 2018. (As cars and trucks,

Accent, Rio, Forte, and G70 compete in a a great deal more compact – and

declining – aspect of the sector when in comparison to crossovers.)

Just as important as the freshness of Hyundai Motor’s product

choices, although, is the relevance of its products. Each the

Hyundai and Kia brands provide entries in each and every a single of the core CUV

segments, from three-row midsize utility down to sub-compact

utility (neither Hyundai nor Kia participates in the entire size

utility segment, but this category accounts for just 2.3% of the

retail market August 2022 CYTD). Finally, the a few-row Palisade and

Telluride crossovers, released in the 2020 product calendar year, for the

1st time offer major competitiveness in one particular of the biggest

segments, and the two products and solutions have currently gained freshenings in

2022.

Genesis, introduced in August 2016, nonetheless lags main luxury brands

in the breadth of its portfolio, and originally was hampered by an

all-car or truck lineup, but it now features 3 crossovers in the heart of

the luxury market.

And finally, Hyundai Motor has demonstrated its competitiveness by

its fast entry into the US EV current market. With the Hyundai Ioniq 5

start final December and the Kia EV6 arrival two months later on, the

company now presents two aggressive EVs, a lot more than many of

its much larger competitors. On top of that, the Ioniq 5 and EV6 now rank

#6 and #7, respectively, amid all EVs (primarily based on August 2022 CYTD

retail registrations) if the 4 Teslas are taken off, the Hyundai

Motor Group goods rank second and 3rd, trailing only the

Mustang Mach-E.

Brand Loyalty

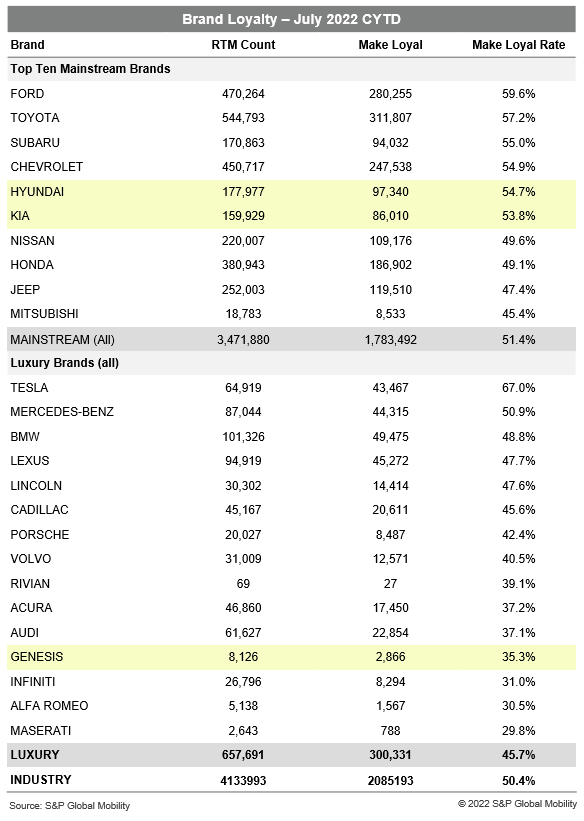

Hyundai Motor’s spectacular retail share partly will come from the two

Hyundai’s and Kia’s ability to retain current owners. As proven

under, these two brands currently rank No. 5 and No. 6 between the 19

mainstream brands in model loyalty. Hyundai Motor is the only

maker to area two makes in the major 10 on this metric.

Each manufacturers have retained such higher percentages of their proprietors

even with not presenting any complete-dimension pickups, midsize pickups, or,

till not long ago, any compact pickups (these 3 pickup segments

account for 17% of the retail marketplace (August 2022 CYTD).

Genesis’ model loyalty has not been as considerable as that of

its stablemates, but element of that is because of to the brand’s newness to

market place. With 7-month model loyalty of 35.3%, Genesis ranks No.

12 between the fifteen luxurious brands for which we have ample

knowledge. Till just lately Genesis loyalty was curtailed by a lack of

crossovers, but the latest additions of the GV60, GV70, and GV80

ought to increase Genesis owners’ probability of buying another

a person.

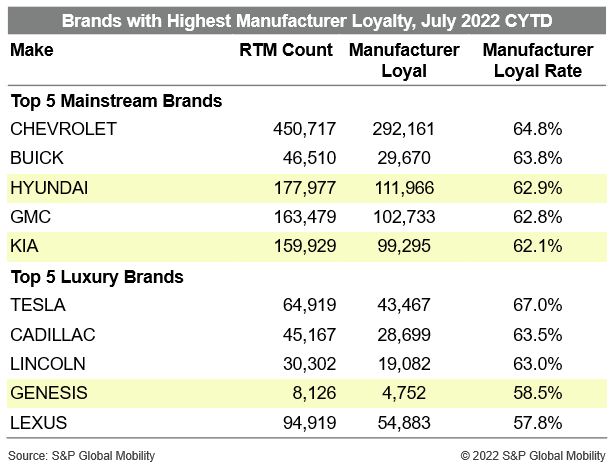

Company Loyalty

S&P Worldwide Mobility registration facts point out that all

three Hyundai Motor brand names have a single metric doing the job in their favor:

even when house owners defect from any of these models, they have a

potent propensity to stay within just the Group. As illustrated below,

the Hyundai and Kia brands rank #3 and #5, respectively, between all

19 mainstream brands based mostly on their probability to stay faithful to

the company – surpassed only by a few GM brands. And, Genesis

ranks No. 4 in the luxury space on this metric, trailing only

Tesla, Cadillac and Lincoln.

While the 3 Hyundai Group brands have created great

progress, it is noteworthy that the Group continue to lacks that

“stand-out” class leader that gets a house name, a la

Camry, Accord, F Sequence. However, the Team has grown from a

second- or third-tier player ten decades ago into a top OEM dependent on

a number of vital metrics, a feat deserving a whole lot of praise in an

market with around 20 OEMs, 40 brand names and 3 hundred models.

—————————————————————————————–

This automotive perception is element of our monthly Best

10 Trends Field Report.The Report findings are

taken from new and utilized registration and loyalty data.

The September report is now available, incorporating July 2022

CFI and LAT facts. To down load the report, be sure to click down below.

Obtain REPORT

This report was posted by S&P World Mobility and not by S&P Global Scores, which is a individually managed division of S&P World-wide.

More Stories

2022 Ford Bronco Raptor Unsurprisingly Thirsty at 15 MPG Combined

How to fix your sagging headliner

The Best 90’s Cars You Can Buy Today