The major problem for OEMs rolling out new battery electric

motor vehicles (BEVs) is rising enter charges, which are impacting price

parity with customarily driven autos. With charges of essential uncooked

products employed in BEVs having risen radically considering that 2019,

S&P World Mobility sees the potential for modifications in customer

conduct, whilst the projected lengthy-term industry share of BEVs is

very likely to be unchanged.

- In general, we count on 2022 to be a calendar year when climbing raw content

rates peak. However, we also count on automakers to be functioning with

significant raw components prices about 75% larger in 2030 than in

2019. Our forecasts for automobile sales, powertrains, and factors

now replicate the impact of that expectation. - In phrases of the existing make-up of the global passenger car or truck

marketplace, we anticipate two important challenges for motor vehicles driven by

standard ICE know-how. For starters, stricter emissions restrictions

will enhance the cost of automobile know-how and emissions

controls. Next, in the shift to electrification, with

reducing volumes of ICE vehicles towards escalating volumes of

BEVs, this will erode the economies of scale of ICE autos and

likely boost their price tag base. - Prior to the rise in significant raw supplies expenditures, some selling price

parity of BEVs with ICE and hybrid types experienced been expected by

about 2025, excluding vehicles in entry-price-stage segments. These

parity would probably outcome in some OEMs leaving the town automobile

section and ever more narrowing possibilities in phrases of entry-amount

A-segment motor vehicles.

Industry dynamics might see some modify

- S&P International Mobility does not be expecting the pricing pressures

to have substantially influence on auto product sales at the topline, even with

expectations that more compact motor vehicle segments will keep minimal BEV

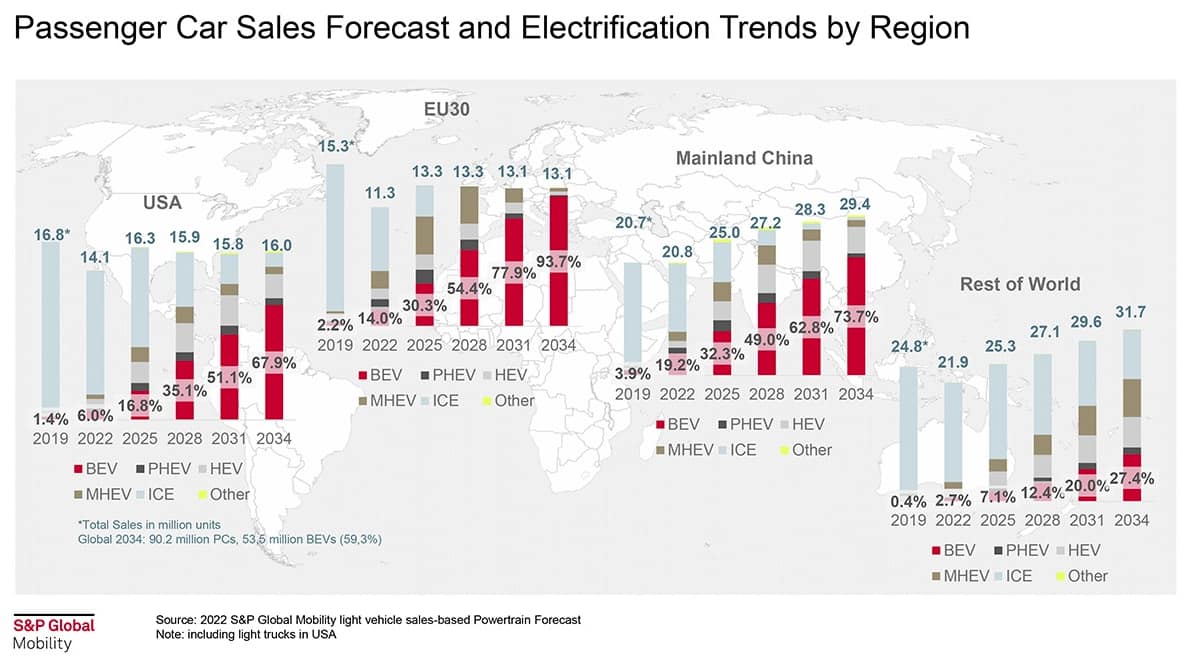

selections as a consequence. In 2031, our latest forecast sees BEVs

achieving a 51.5% sector share in the United States, virtually 78% in

Europe, and about 74% in China. On the other hand, the relaxation of the world is

envisioned to continue on to lag and BEVs to have a market share of only

about 27%.

- OEMs have some resources readily available to them to retain BEV costs in

check. These consist of switching to significantly less-highly-priced lithium iron

phosphate (LFP) battery chemistries. A person probably intriguing

but untried choice for running residual values and lease premiums is

a Toyota proposal for manufacturing unit refreshing of used autos. OEMs may

also choose to reintroduce aggressive motor vehicle discounts, but in the

earlier couple of several years, the business has been moving away from doing

this. - For people, there are also selections. Initially, we will see a

diploma of acceptance of value raises. Consumers are most probable

to settle for selling price raises when they are in the sort of moderate

lease rates for significantly less-price tag-delicate purchasers. Yet another outcome might be

buyers switching to lower-positioned brand names or segments.

Consumers may also improve the holding period of time of a car or decide

to depart the new-auto current market. Both equally of those alternatives have the

potential to have an affect on topline income volumes above time, nonetheless.

This report was revealed by S&P World Mobility and not by S&P World-wide Rankings, which is a independently managed division of S&P Global.

More Stories

Evanston man drove wrong way down street with suspended license, had gun in his possession: police

Mercedes-Benz SLS AMG GT Final Edition in Mars Red

The Roadster | The Jalopy Journal The Jalopy Journal