Table of Contents

American motorists will before long sense the pinch as OPEC and its allied oil-generating companions transfer forward with designs to suppress creation to push up the price of petroleum.

The move is envisioned to reverse the sharp decrease in the cost of crude oil which plunged from additional than $120 a barrel previous June to as very little as $80 in the latest months. With producers signaling they could trim output by as substantially as 2 million barrels a working day, prices have promptly surged, achieving as a lot as $95 a barrel on some indices Thursday morning.

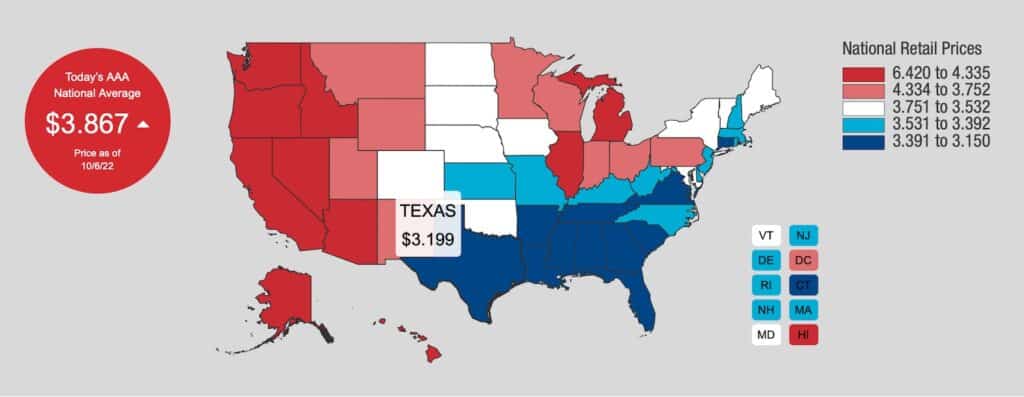

The affect at the pump also came promptly. American motorists saw rates spike to $5.034 a gallon on a nationwide common for frequent unleaded on June 16. That dipped to about $3.60 past month, described tracking service GasBuddy.com, with some service stations briefly dipping below $3. But the trend reversed course as OPEC signaled cuts could be in order late in September. In accordance to AAA, the national common rose to $3.867 Thursday morning, analysts anticipating even more raises as the scope of OPEC’s shift is absolutely understood. A drive past $4 a gallon is broadly predicted.

Biden administration calls out “shortsighted” shift

The response from Washington was swift, the Biden administration labeling the move “shortsighted.”

“In light-weight of today’s motion, the Biden administration will also consult with Congress on added instruments and authorities to decrease OPEC’s control around strength price ranges,” the White House mentioned following the cuts have been announced.

A single feasible shift could see restrictions on the export of U.S. petroleum merchandise. Congress, in the meantime, is deliberating so-named NOPEC laws — quick for “No Oil Developing and Exporting Cartels.”

It is meant to lessen made oil cost spikes and could open up up associates of OPEC and its allies, also recognised as OPEC+, to antitrust lawsuits. The evaluate passed a Senate committee by a vote of 17 to 4 on May well 5, suggesting it could earn bipartisan assist — though past makes an attempt to go these types of anti-rely on measures have stalled in Congress for around two many years.

Iowa Republican Sen. Chuck Grassley was one of the sponsors, along with Minnesota Democrat Amy Klobuchar — the latter stating in May possibly, “I feel that cost-free and competitive marketplaces are better for individuals than markets managed by a cartel of condition-owned oil organizations … competitors is the really basis of our economic procedure.”

Cuts could be sizeable

How substantially of an impact these laws could have is a subject of sturdy discussion. But couple of see something favourable coming from the most current cuts in output with OPEC+ users envisioned to suppress collective output by any where from 500,000 to 2 million barrels a working day. The team by no means fully returned manufacturing to pre-pandemic levels, member states slashing output by a history 10 million barrels a working day when COVID-19 constraints put the international economic climate into a tailspin.

As pandemic restrictions eased, demand from customers for gas, diesel and jet fuel, together with other petroleum products and solutions soared, sending pump prices effectively earlier past history degrees. That fueled inflation globally. In flip, the U.S. Federal Reserve has enacted a sequence of sharp curiosity amount hikes that even the Fed’s Chairman Jerome Powell has acknowledged could induce a recession.

Cuts increase even more fears about U.S., worldwide economies

The condition could be even more intricate by new improves in oil costs. OPEC Secretary-General Haitham Al Ghais stated the goal of the manufacturing cuts was to ensure “security (and) security to the power markets.”

But rather the opposite may well come about, in accordance to some analysts, primarily if climbing price ranges and an economic downturn merge to reduce demand from customers for oil. How a lot bigger rates could go at the pump is far from certain, but something north of $4 a gallon appears certain, gurus warned, primarily if crude oil carries on marching past the $100-a-barrel mark.

More Stories

Amalgam Collection Announces Partnership With IndyCar, Reveals New Dallara Model

Tesla delays deliveries due to missing charge port part

2022 Dodge Durango R/T Hemi Orange revealed