Table of Contents

Automotive Regular Newsletter &

Podcast:

What do funds marketplaces tell us about the automotive

business?

Even though economic markets seize headlines when concern

and volatility are best, the identical markets do also purpose

rationally, and are a window into an ongoing re-evaluation of

companies’ prospective customers and dangers. So, what can we study from the

state of the markets these days?

The autos sector incorporates some of the cheapest and the most

high-priced firms in the world. This simultaneously displays both equally

the inherent problems of legacy carmaking, and the markets’ hopes

for the upcoming beneficiaries of alter. In new months automotive

start ups have confronted a stark valuation fact check, and the

digital closure of the SPAC funding route reflects far higher

scrutiny from investors. Even more funds displacements are most likely

in the coming years as a lumpy technological changeover plays out

all alongside the provide chain. None of this has basically improved

the broad long-expression outlook for electrification. In the meantime in the vicinity of

term, there is a lot of turbulence – notably from currency,

largely to the detriment of US automakers.

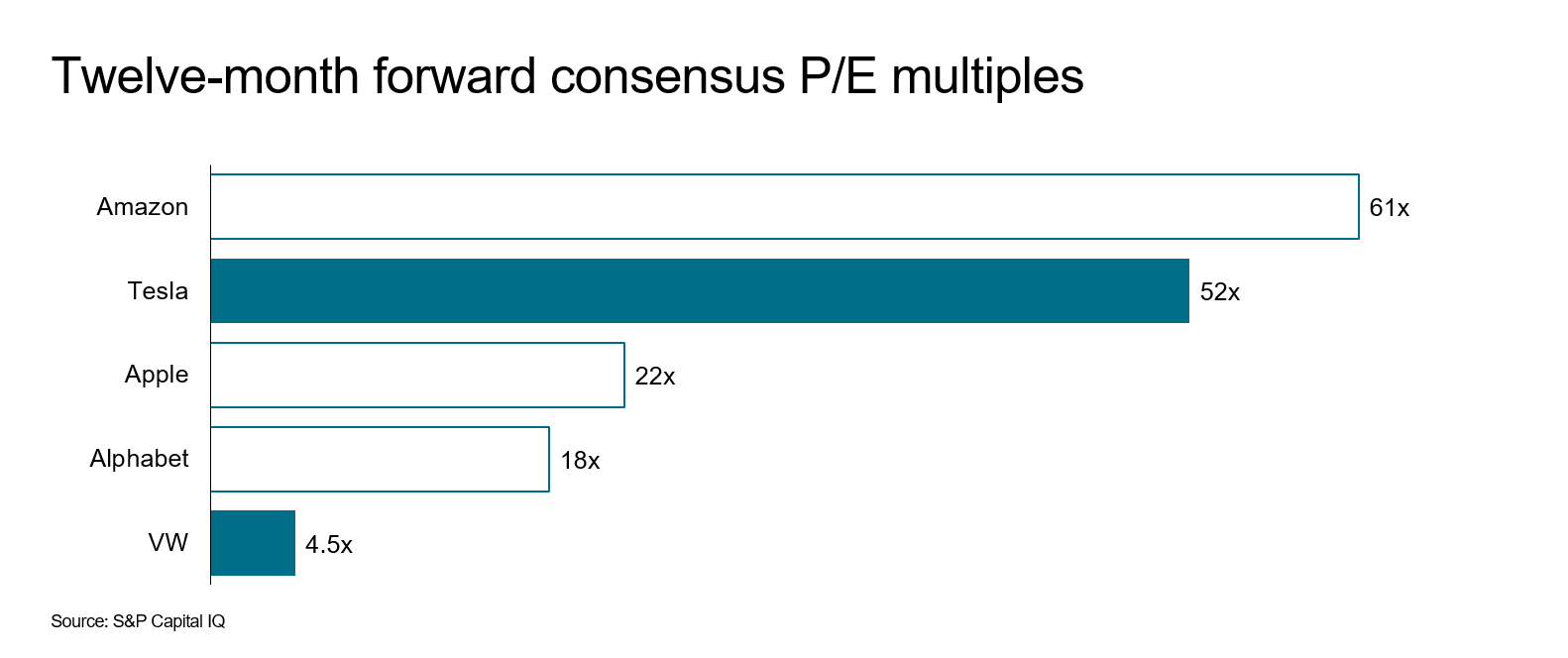

Autos is the most polarised sector

The automaking sector is in the unusual posture of containing

each some of the least expensive – and some of the most highly-priced detailed

providers in the earth. On a single side legacy established automakers –

like VW trades at all-around 4.5 moments its envisioned 2022 earnings. At

the other stop tech-focused electric powered vehicle makers notably Tesla

for which this determine is 52 periods, (vs. for comparison Alphabet

18x, Apple 22x, and Amazon 61x) – additionally many as nonetheless-unprofitable

start out-ups for which no these calculation is yet probable.

Legacy autos’ valuations mirror inherent

challenges

Automakers like VW have traded inexpensively relative to their

earnings for lots of decades. There are numerous causes why: Sector

profitability is low compared to its funds specifications. Equilibrium

sheet possibility is higher due to stock necessities and the need to

pay (and also effectively underwrite) the threats of part

suppliers and seller networks. This in change usually means personal bankruptcy threat

in economic downturns is considerable. The new cohort of start off-ups

promises to handle numerous of these: Lower mechanical complexity

signifies lesser cash demands, and simpler supply chains. A lot less

upkeep indicates few or no standard dealers and decrease

inventories. For this team, staying electric powered-only is the

enabler.

Relative growth expectations underpin the valuation

gap

Nevertheless, the clearest justification for the valuation gap is the

growth differential. This year-to-date, international battery electrical

auto product sales grew 68% vs. prior calendar year, while complete gentle vehicles

contracted by 13%. Legacy automakers entry to that development is

restricted because even BEV changeover leaders like BMW and VW have

close to 6% BEV in their revenue combine. Eventually, legacy automakers are

fighting to protect a $2.5tn sector, though new automakers aspire to

capture it – with small to get rid of.

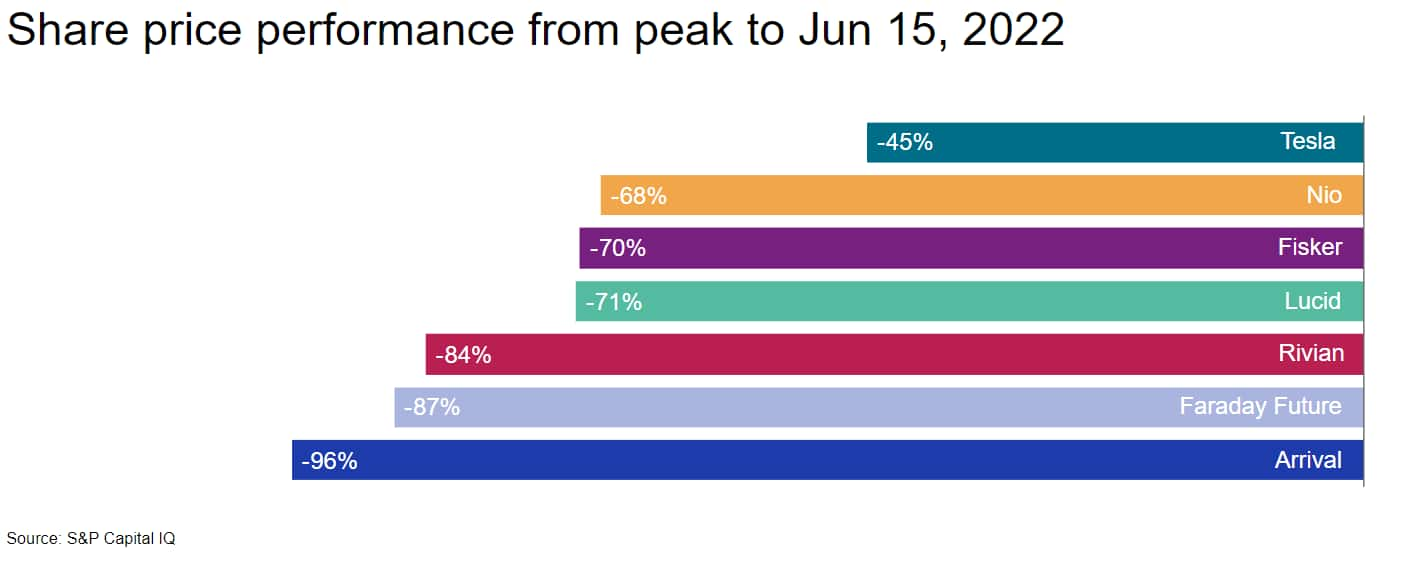

Investor urge for food for ‘New autos’ has waned

radically

New automakers’ valuations have gone through stark changes in

the past calendar year. The chart under lists a choice of electric powered

carmakers and their present market values relative to their

respective peak ranges. These moves are partly macro-driven:

Economic situations have turn into much more hard globally, with

growth slowing, inflation up, and appetite for risky assets in

typical considerably down. Even so, the vital change is probably

expanding recognition of the complications inherent in starting and

scaling automotive output from scratch.

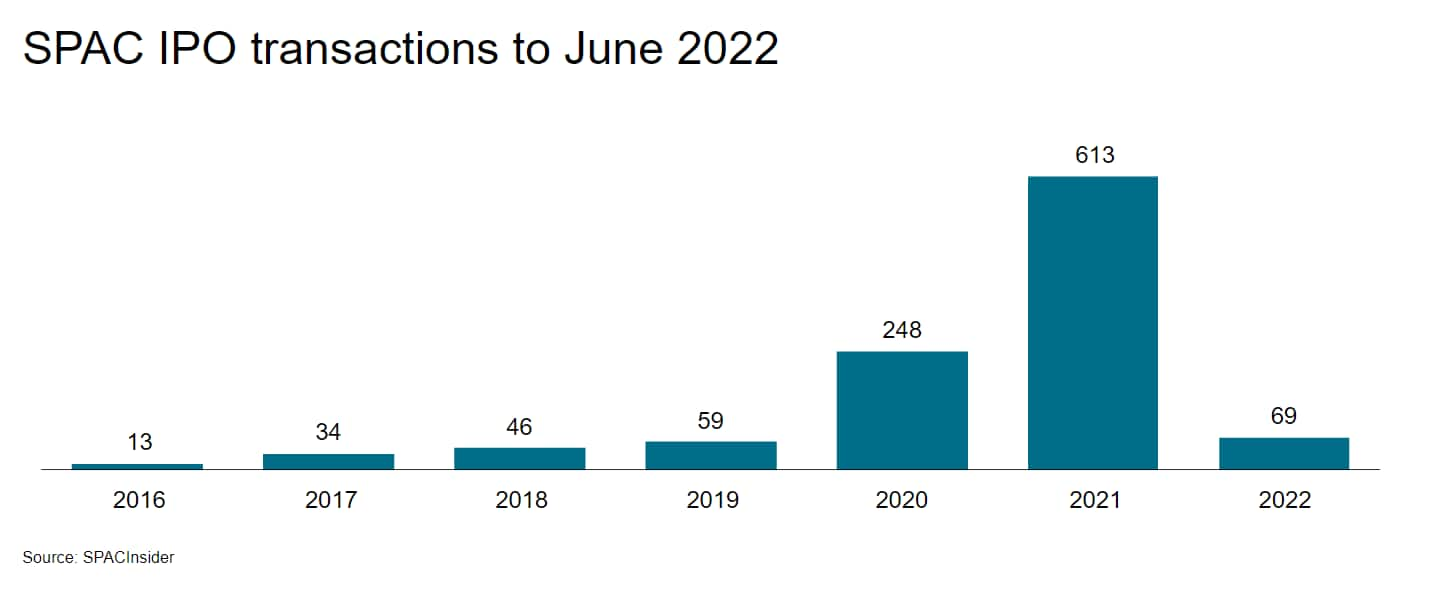

Chosen funding route now shut

At the exact time, the popularity of fundraising via the SPAC

(special objective acquisition business) route has floor to a virtual

halt, with 69 these transactions in 2022 to day compared to 613 for the duration of

2021. EV organizations that went general public through the speculative ‘blank

cheque’ process in 2021 involved Fisker, Polestar, Lucid, and

Arrival. Firms now wishing to comply with in their footsteps are

probable to considerably better fiscal scrutiny.

A bumpy transition

Early current market euphoria has not presented way to the actuality of the

process in entrance of us. Undoubtedly the progress of BEVs and the

commensurate decrease in ICEs (Internal Combustion Engine) will be

the industry’s most essential transition due to the fact its inception early

previous century – this will unquestionably not be clean. A transformation

which considerably impacts all facets of the mobility ecosystem –

innovation, car or truck improvement, program sourcing, output

dynamics, retail engagement and the aftermarket – will be “bumpy”.

This will be uncharted territory at almost every single stage.

Transition speed, commitment by stakeholders (people,

federal government, dealers etcetera.), securing upstream battery raw resources,

altered logistic streams, consumer acceptance/education and learning and an

all-new assistance dynamic all cloud the sky. The recent ICE-targeted

ecosystem took us in excess of a century to hone – expecting a

transformation with minimal drama by the next 10 years is not

real looking.

Money displacement is possible throughout the

ecosystem

The prospect for capital displacement is substantial at all degrees of

the ecosystem. Circumstance in level are the component suppliers. Crucial

to potential innovation, re-investment and most of the present-day motor vehicle

benefit incorporate, quite a few suppliers in system places which disappear in the

BEV environment are faced with critical conclusions. The solutions are to stand

pat and journey the volume decline, pivot, and aim efforts on

devices vital to the BEV place, double-down and be a consolidator in

a declining industry, or merely sell the operation. Timeframes will

fluctuate though the displacement is undeniable. There will most

unquestionably be winners and losers during the transition.

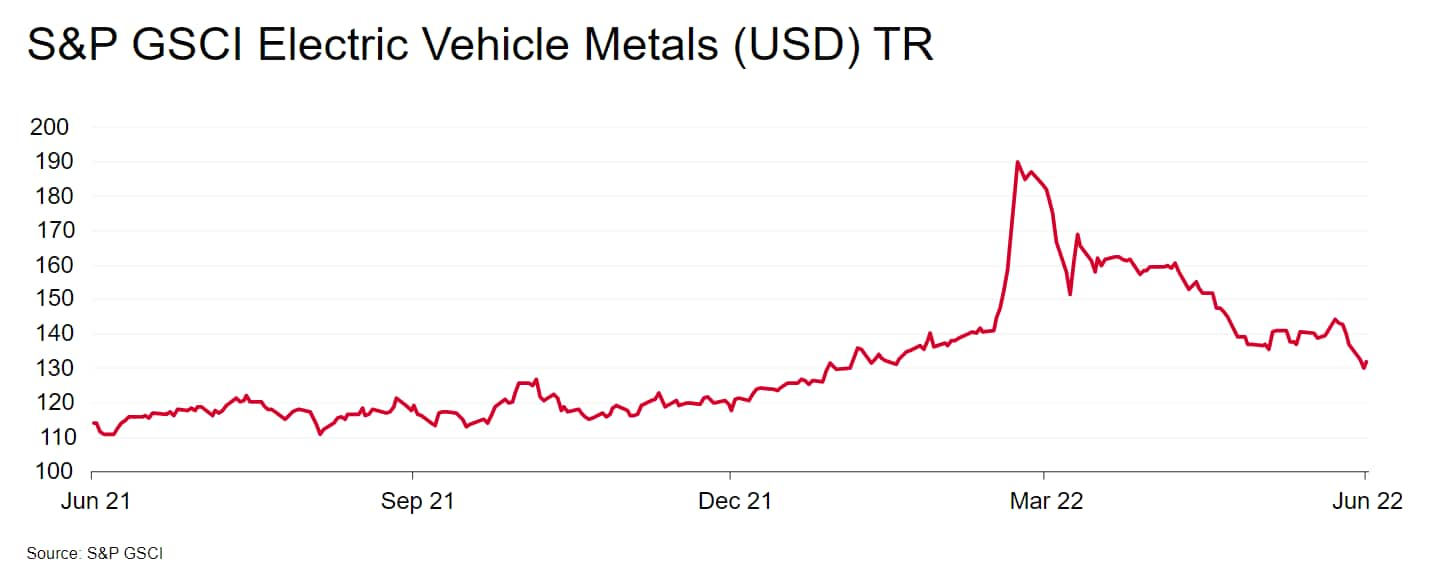

Electrification has not been derailed

Irrespective of the ensuing ecosystems shifts, does this mean

electrification now is not going to come about, or will come about slower? There is

constrained proof of huge improvements to the fundamental outlook. For

a person, the article-Ukraine surge in battery uncooked materials costs has

abated relatively, though still-elevated gasoline costs give

assistance to BEV ownership charges on a relative foundation. On top of that,

regulatory momentum proceeds to perform in favour of electrification,

with the EU parliament notably voting in early June to ban new

interior combustion profits from 2035, albeit still issue to

agreement from notable opponents these kinds of as Germany.

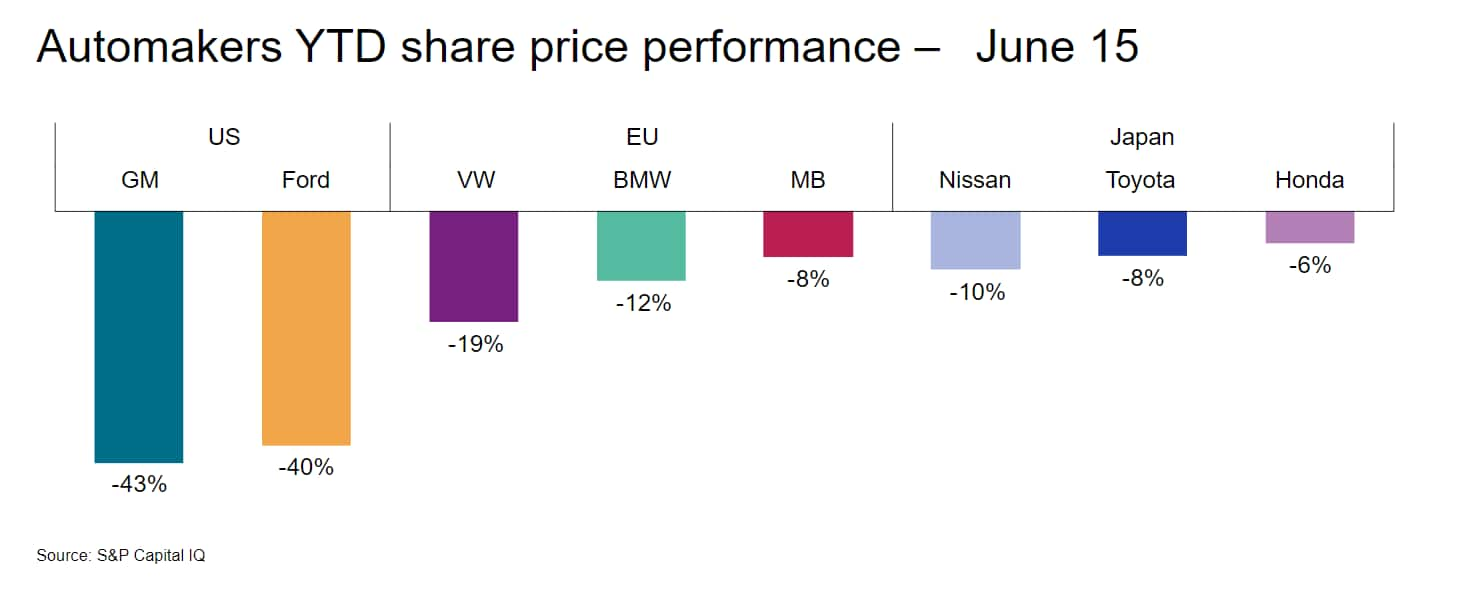

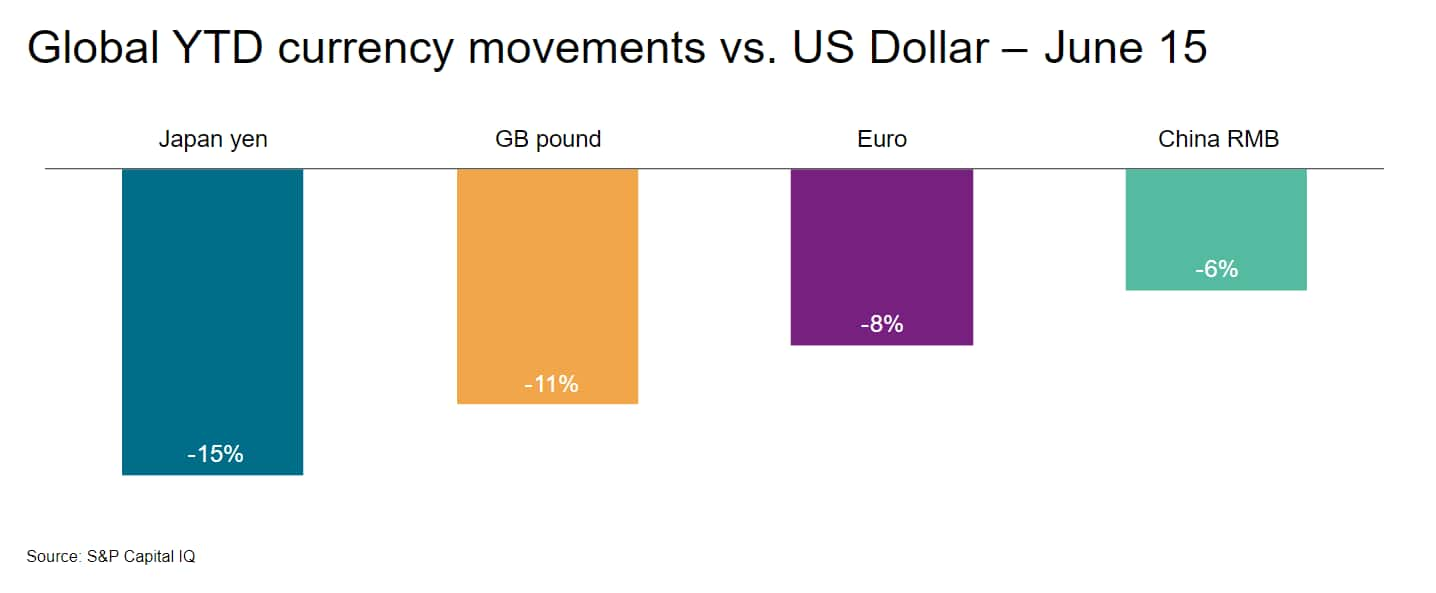

The shifting sands of currency

Ultimately, a notice on forex actions. World wide automakers’

fortunes are to some extent a perform of central banks’

perhaps divergent approaches to tackling inflation in the

coming several years. Especially, a sturdy US greenback is making

problems for US domestic carmakers, and a boost to individuals

elsewhere. The dollar’s 19 12 months large vs. other currencies (USDX

index) hurts GM and Ford mainly because their income from abroad

functions is introduced home at a much less favourable trade charge.

Conversely, a robust dollar is great information for automakers outdoors the

United States, whose abroad gains are boosted by currency

results. No matter whether investing outside the house the United States helps make perception

depends on one’s point of view: A US investor in Nissan would have

viewed its shares drop only 10% but would have misplaced a different 15% from

the weakening yen.

————————————————————————————————-

Dive Further:

Motor vehicle desire insights at your fingertips. Find out

far more.

S&P International Mobility updates

gentle auto creation forecast for June. Study the

post.

Check with the

Expert: Demian Bouquets, Automotive Financial Analyst

Request the Expert: Michael Robinet,

Govt Director, Automotive Consulting Products and services

This write-up was released by S&P Worldwide Mobility and not by S&P World Ratings, which is a independently managed division of S&P World-wide.

More Stories

TAG Heuer Releases A Special Edition Monaco Watch In Time For The 2022 Monaco Grand Prix

History On the Light Box

Review: The 2022 Honda Passport TrailSport trucks up