Investors in Tesla (TSLA) – Get Tesla Inc. Report have quietly appreciated latest trading, like Friday’s action with the shares up 3% on the working day.

The Austin electrical-motor vehicle titan’s shares are now up in four of the previous five classes and three of the earlier 4. In that stretch we’ve viewed a complete rally of pretty much 18%.

And the shares now are tests into a number of essential actions.

This week has been a decisive get for the bulls, just after the shares gapped down on Tuesday adhering to the company’s second-quarter shipping and delivery success.

That basically set up the bulls for a fairly fantastic trade as Tesla held a key assist amount. What they definitely essential was a transfer back up as a result of $700 — and they acquired that on Thursday.

Tesla inventory has continued to energy higher all 7 days, even nevertheless it’s no longer the world’s premier EV producer.

The move also will come as Ark Innovation Fund (ARKK) – Get ARK Innovation ETF Report has ongoing to trade really perfectly about the previous several periods. Tesla is 1 of the premier elements of ARKK.

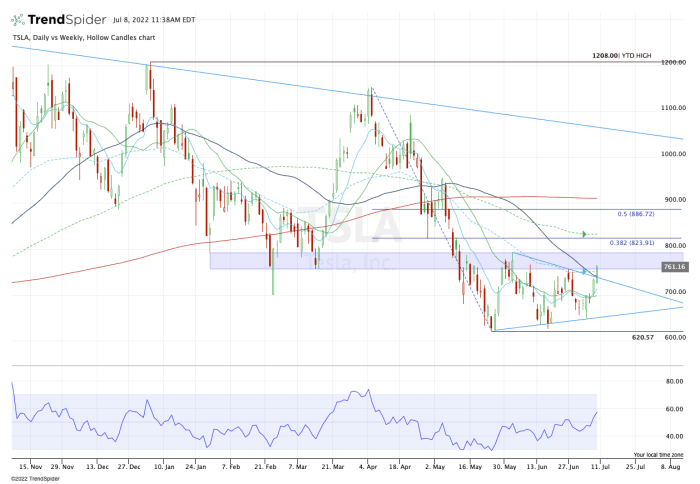

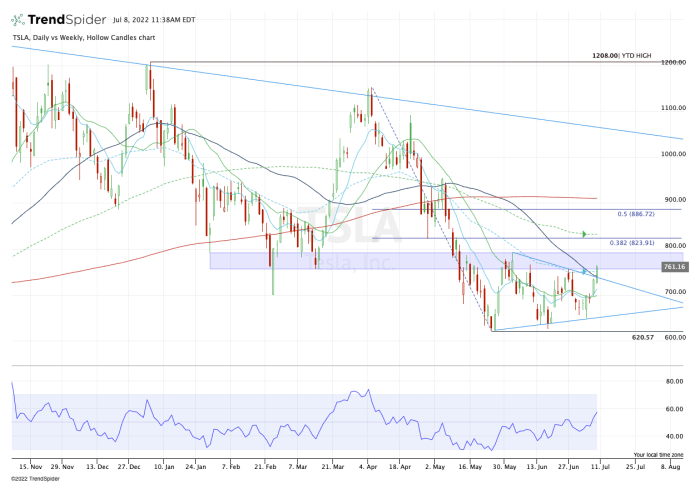

Let us look at the charts to see the new developments.

Buying and selling Tesla Stock

Scroll to Go on

Once Tesla shares burst by $700, they also reclaimed the 10-day and 21-working day transferring averages. For small- and intermediate-time period traders, this was an important improvement.

The go despatched the shares to the 50-working day and 10-7 days going averages, as perfectly as wedge resistance. Now it really is pushing by way of them, and it can be significant for Tesla to hold over these key actions.

Why? Since for a stock to reverse training course, it wants to initial reclaim a resistance evaluate and then use that evaluate as support.

It performs for quick-sellers, too, who glimpse for a inventory to first break down below help, then locate resistance at that amount.

Tesla has now reclaimed these levels. So if it can go a move further more and obtain the 10-week and the 50-working day moving averages as aid, the bulls can acquire more momentum.

If the shares can shut earlier mentioned $750, let us see if they can push to the June high at $792.63. On a month-to-month-up rotation, it could place the 38.2% retracement in engage in close to $825, along with the declining 21-7 days relocating common.

On the draw back, the bulls want to see Tesla stock keep the 50-day and 10-7 days shifting averages as help. But they require $700 to maintain, alongside with the 10-day and 21-day relocating averages.

A split of all these measures will place uptrend assist again in play (blue line).

The bottom line: Tesla stock can be a huge driver, not just for ARKK but for sentiment as a full.

If it can continue on better, it might bode properly for inventory-current market bulls. But a breakdown would have the bears searching to regain momentum.

More Stories

Amalgam Collection Announces Partnership With IndyCar, Reveals New Dallara Model

Tesla delays deliveries due to missing charge port part

2022 Dodge Durango R/T Hemi Orange revealed