Table of Contents

A whole lot of industries are cooling off appropriate now thanks to runaway inflation, soaring fascination fees, and decelerating purchaser expending. Amid this world wide financial slowdown, electric car or truck adoption is on the increase. And the EV Revolution is powering total-steam in advance.

Source: Ilija Erceg / Shutterstock

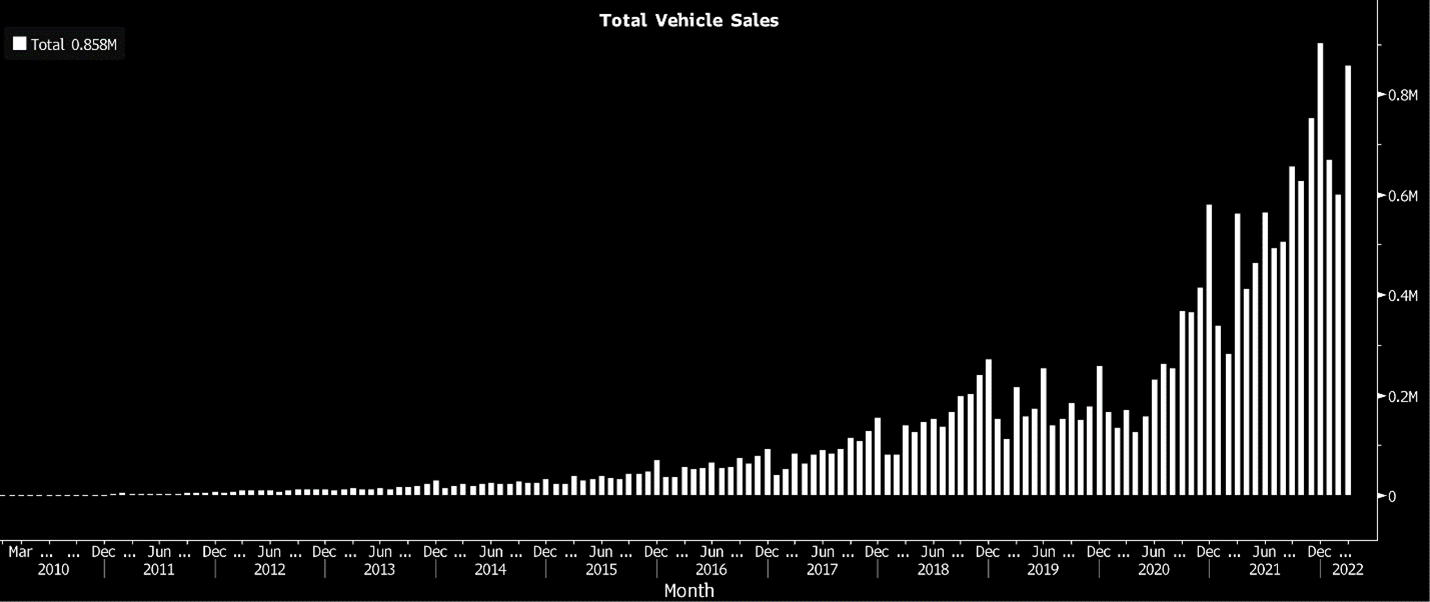

With fuel price ranges at the pump ticking over $5 a gallon, people are understandably a lot more interested in heading electric powered. And EV revenue have adopted fit.

Via the 1st a few months of the year, much more than 2.1 million electric powered autos were bought around the globe. Which is up an astounding 80% 12 months-above-yr.

And we consider the crimson-very hot EV business is only likely to get hotter.

Gas selling prices job to keep on being significant. But EV battery metallic prices have been swiftly declining soon after an early 2022 spike. That’s more closing the gap in between gas-powered and electrical automobile price ranges. And China — dwelling to 60% of the world’s EV battery production — is reopening right after repeated COVID-19 lockdowns. This is enabling considerably more strong world EV creation through the remainder of the year. Even further, the Chinese governing administration is extending EV tax breaks. And the leaders of the G-7 nations just formed a committee termed the “Climate Club.” It’s devoted to spearheading substantial EV adoption by 2030.

The proverbial stars have aligned for the EV field to increase speedier than ever just before about the subsequent couple of months. As that takes place, we absolutely count on electric car shares to electrical power as a result of any recession that may be on the way.

You can participate in this coming EV stock breakout in a good deal of ways. But there is handful of superior selections than with EV charging shares. Here’s why.

The Circumstance for EV Charging Stocks

Enable me talk to you a very simple question: What great is a car without a gas station?

Not much very good at all. With out gasoline, a car or truck is quite considerably a paper pounds on wheels. With out gas stations, our cars and trucks do us no excellent.

By that same token, what fantastic is an electric automobile without a charging station?

An EV operates on an electrical cost. If that demand operates out and there’s nowhere to refuel, then the auto is ineffective.

No charging stations, no usable EVs.

Now, we have all known about the electrical automobile megatrend for a though now. Over the following 10 a long time, every person buys a Tesla (Nasdaq:TSLA), Lucid (Nasdaq:LCID), or some other electric auto. But what takes place when they’re touring, and there is nowhere to charge it?

Certainly, the electrical car or truck megatrend will not materialize unless an similarly big progress spurt occurs in EV charging infrastructure.

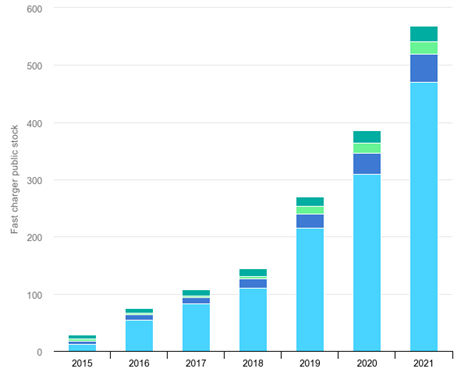

That’s why, in its just lately launched 2022 EV Industry Outlook report, the Global Energy Company said that the selection of EV chargers globally need to boost 12X by 2030. And that is just sufficient for firms and governments to arrive at the very low stop of their targets for 30% of new automobile product sales to be electrical by then.

In other phrases, the EV marketplace will mature by all-around 3X to 4X about the upcoming 10 years. But the EV charging industry will grow by 12X over that exact same extend.

So, if you want to perform the EV Revolution for certainly monumental gains, neglect about electric auto makers like Tesla. Buy picks-and-shovels suppliers like EV charging shares.

Lucky for you, we have the prime choose in the room.

Gaining an “Edge” in Electric Vehicle Charging Stocks

Considering the over, you are in all probability pondering that it is time to rush out there and purchase some EV charging shares, correct?

Not so speedy.

There are tons of EV charging providers out there today. Not all will make it. In fact, only a handful will make it big. Most will are unsuccessful. So, it is not time to purchase all EV stocks. Somewhat, it’s time to purchase the very best of them.

To know which are “the greatest,” let us to start with recognize EV charging know-how.

That examination commences with the basic query: How does energy perform?

In quick, we crank out electrical energy at a ability source, like a coal-fired electric power plant or a photo voltaic farm. Then we endorse the movement of electrons (the charged particles that have electric powered ability) outward from that resource by using wires. This stream of electrons is termed a “current.”

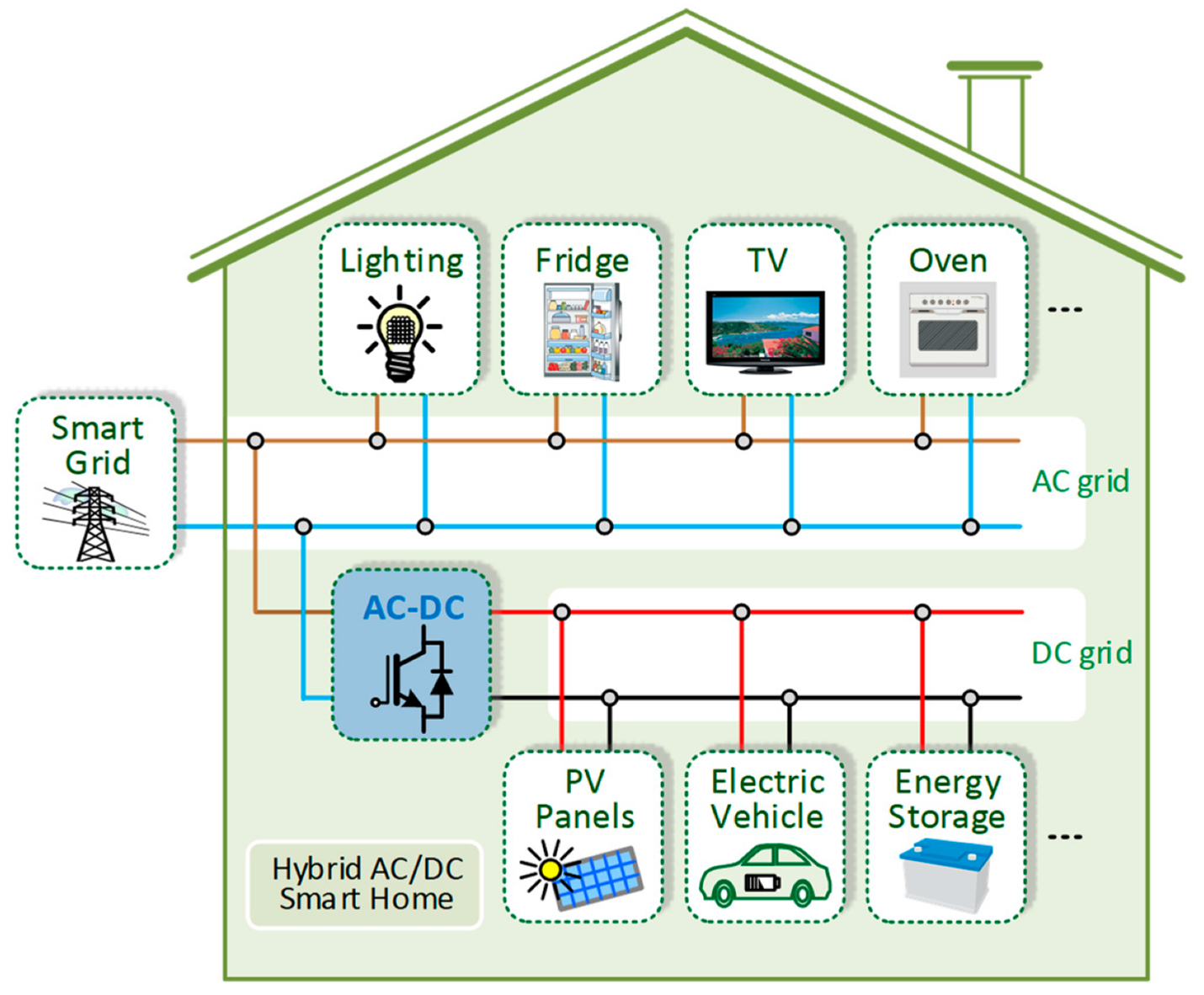

That latest can get two types: alternating present-day (AC) or direct current (DC). DC is a immediate continual movement of electrons by means of the wire. It results in heavy ability supply but also in significant drain on the grid. AC is an oscillating flow of electrons that effects in lower power supply but small tension on the grid.

Because the grid has often been load-constrained, we resolved prolonged ago to develop it on AC. But due to the fact an alternating existing physically hinders the capacity to store strength, today’s batteries can only store energy as DC.

Which is why most electronics units, like laptops, arrive with energy cords that have major containers in the middle of them. Those bins are AC/DC converters. They transform the AC electrical power from the grid to DC energy that can be stored in your laptop computer.

EV charging works in a lot the very same way.

The chargers plug into the grid, which provides AC power. That electricity is then pumped into the electric powered motor vehicle. On board each and every EV, there is an AC/DC converter that turns AC electrical power into usable DC power. And that is then saved in the car’s battery.

How to Pick the Greatest EV Charging Stocks

Knowledge how EV charging operates is not all you have to have to know to decide on the very best EV charging shares. You also want to know the different sorts of EV chargers out there. Then you can select the corporations that make the most practical, best-quality chargers.

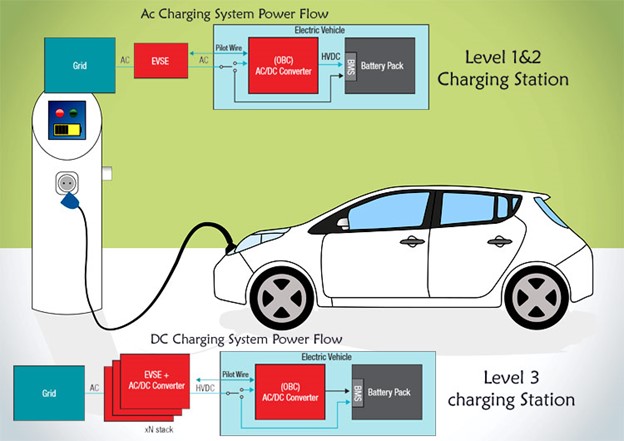

There are two classifications of AC electric car or truck chargers — L1 and L2.

L1 chargers are the most fundamental out there. They are genuinely gradual but truly affordable. They’ll give you about 3 to five miles of assortment for each hour of charging. Supplied that they’re very low-expense, very low-effectiveness in mother nature, L1 chargers are typical as household remedies. But they’re extremely rarely utilised past the home.

L2 chargers are a big action up from L1s. They are a lot speedier but also considerably much more expensive. They’ll give you all around 30 miles of array per hour of charging. These L2s represent the vast majority of chargers on the road today.

There are also DC rapid chargers. These are essentially unique from AC chargers. They have created-in AC/DC converters that change grid energy into DC electrical power within just the true charger itself. What this permits, then, is for the charger to pump DC electricity straight into an EV battery. This wholly bypasses the AC/DC converter in the automobile and success in a far more effective charge.

These chargers are genuinely, definitely fast — and truly, definitely expensive. As a end result, they can give you around 100 miles of vary for every hour of charging. But there aren’t several of them on the streets these days — just a several thousand across the whole U.S.

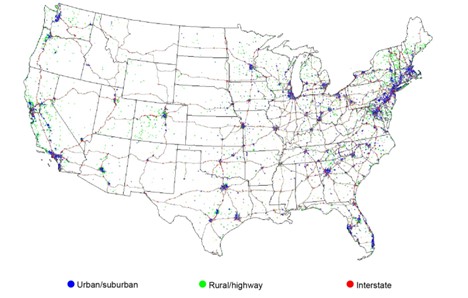

Contemplating this context, it’s critical to have an understanding of that the long run of the EV charging landscape will be a blend of largely L2 chargers throughout city regions and some DC rapidly-chargers on interstate highways.

That is due to the fact L2 chargers are very good adequate. The massive shift from gas stations to charging ports will be accompanied by a large shift in wherever we “refuel.”

Due to the fact EV chargers are little and can be built any where there is an electric powered link, the times of committed gasoline stations are over. You will not see EV charging stations switch fuel stations. You’ll see fuel stations become extinct. EV charging ports will pop up just about everywhere — your health and fitness center, grocery keep, and regional shopping mall parking ton.

In the EV Charging Revolution, you will demand your electrical car or truck in all places you go. So extensive as you aren’t traveling hundreds of miles, L2 chargers will do the position just great. That’s because you’ll be charging as you store or operate out.

For those people very long road trips… properly, that’s where by DC speedy chargers will be tremendous practical.

Not to point out that charging does actually charge dollars. Ideal now, it costs about $2 for every 30 minutes of L2 charging in a community great deal.

To that close, the foreseeable future of EV charging is super clear. Tens of millions of L2 chargers will pop up throughout every parking whole lot in urban and suburban locations. DC speedy chargers will replace gas stations on interstate highways, and shoppers will be paying for all that cost.

That is the foreseeable future.

So, which EV stocks need to you be buying ideal now to enjoy that foreseeable future?

The Last Word on the Electric Car Revolution

We really don’t just hear to management groups and study investor decks to remedy those queries.

Nope. In its place, we turn to Innovation Investor, exactly where we leverage a group of authorities — from software engineers and details researchers to seasoned traders and economists — to fully fully grasp technological megatrends at their most fundamental stage. In this article, we break down each individual company’s fundamental engineering at their most elementary ranges to evaluate validity and capacity. And we search to see if they have the opportunity to change the environment.

We do this with each company throughout every single industry and for each technological breakthrough. The conclusion final result: We determine early phase hypergrowth tech shares set for huge prolonged-time period returns.

And it is in the EV sector where we’ve located a single inventory that’s produced astoundingly excellent, unique know-how. That tech ought to allow it to turn into a dominant provider for the total EV field.

The most effective aspect? As you might know, Apple (Nasdaq:AAPL) is on the cusp of launching its have self-driving electric vehicle. And the enterprise we have recognized may perhaps have a mystery partnership in the functions with Apple.

As such, this inventory is a opportunity 40X financial commitment possibility from present-day stages.

Right after all, it could be the key business at the rear of Apple’s next big product or service launch.

On the date of publication, Luke Lango did not have (both specifically or indirectly) any positions in the securities stated in this article.

More Stories

Amalgam Collection Announces Partnership With IndyCar, Reveals New Dallara Model

Tesla delays deliveries due to missing charge port part

2022 Dodge Durango R/T Hemi Orange revealed